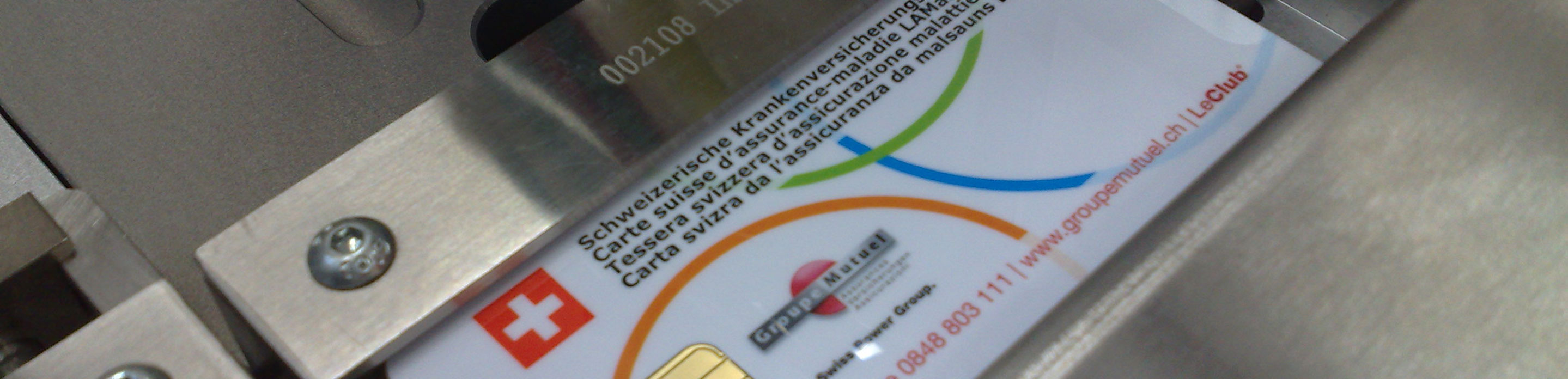

The exceet Card Group is a major European provider of comprehensive smart card solutions (magnetic stripe or chip-based): bank cards, transport cards, access cards, fidelity cards, gift cards… Thanks to the takeover of the Swiss company Intercard in December 2020, the group now has a foothold in all the DACH region. It also has strengthened its position and expertise on the “Healthcare & Government” segment, since Intercard has been for many years the provider of health insurance cards and driving licenses in Switzerland.

“In our business, the first step is manufacturing the support – the blank card –, then customising it, and processing the related data,” explained Ulrich Reutner, CEO of the exceet Card Group. “With Intercard, we now have a customisation unit in Switzerland, as in Austria and Germany.” The group’s strategy is to acquire other targets, notably customisation units in other European countries, and to increase its production of blank cards (currently over 300 million per year) in its Kematen facility (Austria).

High-margin niches

“When sensitive information is accessible through their cards,” added Tobias Lienhard, Principal for Crédit Mutuel Equity in Switzerland, “clients often ask for customisation to be done locally.”

Giving priority to small series, complexity and a diversified client base

In small countries, the corresponding volumes present little interest to the major players of the smart card market, as they are focused on large series for telecoms and financial services. This leaves room for “specialists” such as the exceet Card Group, manufacturing smaller and more complex series, for a more diversified client base. By providing proximity, flexibility, reactivity, and strong data security, the group can count on higher margins.

Being aware of environmental issues, the exceet Card Group also positions itself as a responsible partner. The energy used for production comes for 90% from solar or hydro power. Thus, over 400 tonnes of CO2 are saved each year thanks to the solar panels installed on the roofs of the facility in Kematen. Moreover, the company was the first in the world to provide wooden bank cards certified by Visa and Mastercard.

New acquisitions in sight

“On a thriving market, we have chosen to get involved with leaders who have a real vision and a strong industrial mindset to form a larger and more relevant group,” highlighted Tobias Lienhard. With its successful raising of capital and takeover of Intercard, the group is now in a strong position to take advantage of new purchase opportunities, already under study.

For Ulrich Reutner, Crédit Mutuel Equity was the obvious choice. “Right away, we felt that we could trust Tobias Lienhard and Fabienne Mazières, CEO of Crédit Mutuel Equity in Switzerland. Here is a partner who invests its own funds, like the entrepreneurs that we are. So, we have a similar approach. Besides, with his expertise in this field, Tobias can efficiently assist us in analysing external growth opportunities, structuring operations and negotiating.”